The Bansal Wire IPO is poised to be one of the significant events in the financial calendar of 2024, with an issue size of Rs 745.00 crores. This public offering is entirely a fresh issue of 2.91 crore shares, indicating the company’s strategic move to raise substantial capital for its future endeavors. Moreover, The IPO opens for subscription on July 3, 2024, and closes on July 5, 2024. With the allotment expected to be finalized by July 8, 2024, and the shares listing on the BSE and NSE by July 10, 2024, investors are keenly watching this space.

IPO Details

The price band for the Bansal Wire IPO is set between ₹243 to ₹256 per share, making it accessible to a broad range of investors. The minimum lot size for an application is 58 shares, translating to a minimum investment of ₹14,848 for retail investors. For larger investors, such as sNII (small non-institutional investors) and bNII (big non-institutional investors), the minimum investment amounts to ₹207,872 and ₹1,009,664, respectively. This structured approach ensures that the IPO appeals to a diverse investor base, from individual retail investors to large institutional players.

SBI Capital Markets Limited and Dam Capital Advisors Ltd (formerly IDFC Securities Ltd) are the book-running lead managers for the IPO Likewise, ensuring a well-managed and transparent process. Kfin Technologies Limited is the registrar for the issue, playing a crucial role in the allotment and listing process.

Reservation and Timeline

The Bansal Wire IPO has a structured reservation system to cater to different investor categories. Not more than 50% of the net issue is reserve for qualified institutional buyers (QIBs), not less than 15% for non-institutional investors (NIIs), and not less than 35% for retail investors. Therefore, This allocation strategy ensures a balanced distribution of shares among various investor classes, fostering widespread participation.

The IPO timeline is meticulously plan. It opens on July 3, 2024, and closes on July 5, 2024. The basis of allotment will be finalize by July 8, 2024, with the initiation of refunds and credit of shares to demat accounts scheduled for July 9, 2024. Moreover, The listing date on the BSE and NSE is set for July 10, 2024, marking the culmination of this significant financial event.

Company Overview

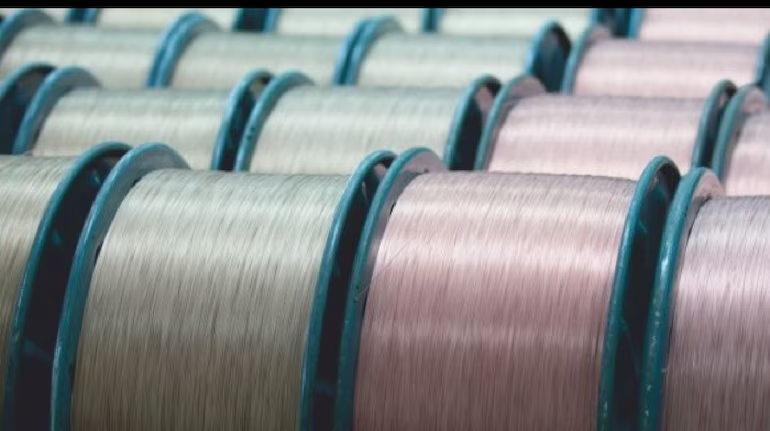

Incorporated in December 1985, Bansal Wire Industries Limited is a prominent player in the stainless steel wire manufacturing industry. The company operates in three main segments: high carbon steel wire, low carbon steel wire (mild steel wire), and stainless steel wire. With a portfolio of over 3,000 different types of steel wire products, Bansal Wire serves more than 5,000 customers across various industries. This diverse customer base helps mitigate risks associated with over-reliance on a single customer or industry segment.

Bansal Wire has a robust presence in both domestic and international markets, exporting products to over 50 countries. Its global footprint includes representatives in countries such as Bangladesh, Brazil, France, Germany, Israel, Italy, Netherlands, South Korea, South Africa, Sri Lanka, Turkey, the United Kingdom, the United States, and Vietnam. Furthermore, This extensive network underscores the company’s strategic focus on expanding its market reach and solidifying its position as a global leader in the steel wire industry.

The company operates four manufacturing units located in Mohan Nagar, Ghaziabad, Loni Industrial Area, Ghaziabad, and Bahadurgarh, Jhajjar, Haryana. Eventually, These units are strategically place to optimize production efficiency and meet the growing demand for its products. Since 2021, Bansal Wire has also established a sales team of over 50 experienced professionals to cover all regions of India, ensuring comprehensive customer service and support.

Financial Performance

Bansal Wire Industries Limited has demonstrated consistent financial growth. Between the financial years ending March 31, 2023, and March 31, 2024, the company’s revenue increased by 1.99%, while profit after tax (PAT) surged by 31.48%. The company’s assets stood at ₹1,264.01 crore as of March 31, 2024, compared to ₹749.05 crore the previous year. The revenue for the year ending March 31, 2024, was ₹2,470.89 crore, with a PAT of ₹78.80 crore.

Key performance indicators for the company are impressive, with a return on equity (ROE) of 21.19%, return on capital employed (ROCE) of 18.46%, and a debt-to-equity ratio of 1.48. These metrics highlight the company’s efficient use of capital and sound financial management.

Objectives of the IPO

The primary objectives of the Bansal Wire IPO include the repayment or prepayment of certain outstanding borrowings, funding the working capital requirements of the company, and general corporate purposes. By reducing its debt, the company aims to enhance its financial flexibility and improve profitability. Moreover, The infusion of fresh capital will also support the company’s growth plans, including the addition of a new segment of specialty wires through its upcoming plant in Dadri.

Market Comparison and Pricing

The IPO’s price-to-earnings ratio (P/E) based on fiscal 2024 earnings is 39.32 times at the floor price and 41.42 times at the cap price. This pricing is competitive compare to the average industry peer group P/E ratio of 32.72 times. Listed peers of Bansal Wire include Rajratan Global Wire Ltd, DP Wires Ltd, and Bedmutha Industries Ltd, with P/E ratios of 41.68, 18.94, and 37.52, respectively. This comparison underscores the attractive valuation of Bansal Wire’s shares in the context of industry benchmarks.

Promoters and Shareholding

The promoters of Bansal Wire Industries Limited include Arun Gupta, Anita Gupta, Pranav Bansal, and Arun Kumar Gupta HUF. Their pre-issue shareholding stands at 95.78%, reflecting a strong promoter commitment to the company’s success. Post-issue, the promoter holding will be dilute but will still represent a significant stake in the company, ensuring continue alignment of interests with those of other shareholders.

Conclusion

In conclusion, The Bansal Wire IPO presents a compelling investment opportunity, given the company’s robust financial performance, strategic growth plans, and competitive pricing. With a diverse product portfolio, a strong presence in domestic and international markets, and a solid track record of financial growth, Bansal Wire is well-positioned for future success. The funds raised through the IPO will help the company reduce debt, meet working capital requirements, and support its expansion plans, making it an attractive proposition for both retail and institutional investors. As the Bansal Wire IPO opens for subscription, investors have a chance to be part of this promising journey in the steel wire manufacturing industry.