RBI MPC Meet 2024: Key Decisions and Economic Outlook

The RBI’s Steadfast Approach

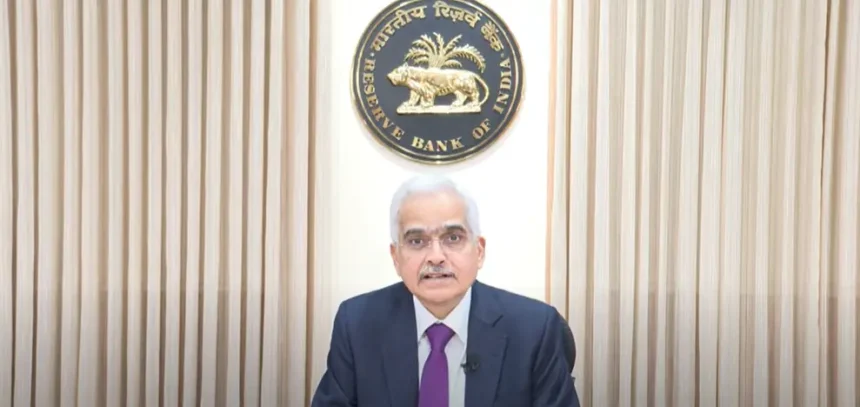

RBI MPC Meet 2024 : On August 8, 2024, the Reserve Bank of India (RBI) concluded its Monetary Policy Committee (MPC) meeting with a steadfast decision to maintain the repo rate at 6.5%. This marks the ninth consecutive meeting where the rate has remained unchanged, reflecting the central bank’s cautious and steady approach in navigating the complex economic landscape.

Repo Rate and Policy Stance

Unchanged Repo Rate

The decision to keep the repo rate at 6.5% was anticipated by many market watchers. The vote within the MPC was not unanimous, with a 4:2 majority supporting the decision. This indicates a balanced yet cautious approach by the RBI in managing the country’s monetary policy.

“Withdrawal of Accommodation” Stance

The RBI also decided to maintain its “withdrawal of accommodation” stance. This policy position signals the central bank’s intent to continue normalizing the liquidity conditions in the market, aiming to ensure that inflation remains under control while supporting economic growth.

GDP Growth Projections for FY25

Steady Growth Forecast

The RBI kept its projection for real GDP growth in FY25 unchanged at 7.2%. This stable outlook underscores the central bank’s confidence in the resilience of the Indian economy. The growth projections for each quarter are as follows:

- Q1: 7.1%

- Q2: 7.2%

- Q3: 7.3%

- Q4: 7.2%

Global Economic Outlook

Challenges Amidst Long-Term Strength

Governor Shaktikanta Das highlighted that while the long-term outlook for global growth remains strong, the medium-term scenario is fraught with challenges. Factors such as geopolitical tensions, supply chain disruptions, and fluctuating commodity prices contribute to this uncertain environment.

Volatility in Financial Markets

Global financial markets have shown significant volatility, which is a concern for both domestic and international economic stability. The RBI is keeping a close watch on these developments to mitigate any potential adverse effects on the Indian economy.

Domestic Economic Resilience

Urban Consumption Driving Growth

Domestic economic activity is showing resilience, driven primarily by steady urban consumption. The sustained demand in urban areas is a positive indicator of economic health and consumer confidence.

Fixed Investment Activity

Investment activity in the economy remains buoyant, supported by both public and private sector initiatives. This continued investment is crucial for long-term economic growth and infrastructure development.

Agricultural and Manufacturing Sector Outlook

Positive Agricultural Prospects

The progress in the southwest monsoon and the increase in Kharif sowing are positive signs for the agricultural sector. Higher reservoir levels also augur well for the upcoming harvest, which is expected to contribute significantly to rural income and overall economic stability.

Manufacturing Sector Growth

Manufacturing activity is gaining momentum, driven by improving domestic demand. This sector’s growth is a crucial component of the overall economic recovery and sustainability.

Inflation Projections

CPI Inflation Estimate

The RBI maintained its earlier estimate of Consumer Price Index (CPI) inflation for FY25 at 4.5%. This consistent projection indicates that the central bank expects inflationary pressures to remain within manageable levels, ensuring that price stability supports economic growth.

Monetary Policy Decision-Making Process

Diverse Opinions Within the MPC

The 4:2 vote on maintaining the repo rate and policy stance highlights the diverse opinions within the MPC. This diversity reflects the complexity of the economic environment and the need for a balanced approach to monetary policy.

Focus on Inflation

Governor Das emphasized that the primary focus of the MPC is on controlling inflation to support sustainable growth. This approach aligns with the RBI’s broader mandate of maintaining price stability while fostering economic development.

Conclusion: A Balanced Approach to Economic Management

The RBI’s decision to maintain the repo rate and its current policy stance reflects a cautious yet optimistic view of the Indian economy. By focusing on inflation control and supporting growth through steady policy measures, the RBI aims to navigate the economic challenges posed by global volatility and domestic demand dynamics.

Read More: Naga Chaitanya and Sobhita Dhulipala’s Engagement

After the Conclusion: Reflecting on RBI’s Strategy

The RBI’s approach highlights the delicate balance central banks must maintain between fostering economic growth and controlling inflation. The decisions taken in this MPC meeting underline the importance of steady and measured policy actions in ensuring long-term economic stability and resilience.