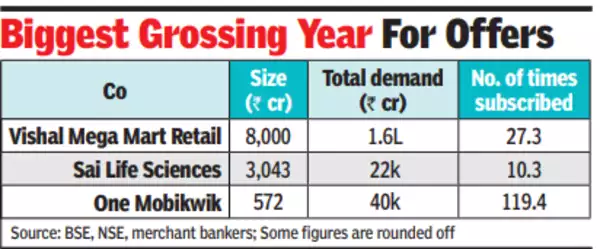

What a year 2024 has been for BSE and NSE IPO markets! Three major IPOs—Vishal Mega Mart, Sai Life Sciences, and One Mobikwik—have set the stage ablaze, collectively amassing a whopping Rs 2.2 lakh crore in investor demand. It’s a record-breaking feat that proves the public’s appetite for new listings is far from diminishing. Let’s dive deeper into the details of these IPOs and what made them stand out this year.

What Are IPOs, and Why Do They Matter?

For starters, IPOs, or Initial Public Offerings, are a company’s way of going public by offering its shares to retail and institutional investors for the first time. But why is everyone so excited? Think of IPOs as grand openings of a new store—there’s buzz, excitement, and, of course, the potential for rewards. For companies, it’s a means to raise capital. For investors, it’s an opportunity to become part of a promising growth story.

Breaking Down the Rs 2.2 Lakh Crore Milestone

Let’s talk numbers. These three IPOs collectively aimed to mobilize Rs 11,615 crore, but investor interest overshot expectations, generating Rs 2.2 lakh crore in demand. That’s a staggering 19x the original target—a clear indication of the robust investment environment.

One Mobikwik: The Star of the Show

Among the trio, One Mobikwik stole the spotlight with an unprecedented 120-fold oversubscription. That’s right, 120 times! This tech-driven payments enabler aimed to raise Rs 500 crore but ended up attracting the lion’s share of investor enthusiasm. In fact, retail investors flocked to this IPO, making it 2024’s most sought-after IPO on both BSE and NSE.

Why the hype? Think of One Mobikwik as a digital powerhouse—streamlining payments with technology and riding the digital transformation wave that’s sweeping the globe. Everyone wants a slice of that pie.

Vishal Mega Mart: A Retail Giant in the Making

Vishal Mega Mart also saw remarkable success, with its Rs 8,000 crore IPO being oversubscribed 27 times. That translates to total investor demand of Rs 1.6 lakh crore. The brand’s strong retail presence and its proven growth trajectory made it an irresistible pick for investors seeking stability and returns.

Sai Life Sciences: A Silent Performer

The third IPO, Sai Life Sciences, wasn’t far behind. With a target to raise Rs 3,043 crore, this pharma and biotech player’s offer was oversubscribed 10.3 times, bringing in Rs 21,881 crore in demand. Investors recognize the immense potential of the healthcare sector, and Sai Life Sciences’ focus on innovation and R&D was the perfect recipe for success.

Comparing 2024’s IPO Rush to Previous Years

So, how does 2024 stack up against previous years? Let’s rewind to 2021, which held the previous record with Rs 1.2 lakh crore raised through 63 IPOs. This year, IPOs have already mobilized Rs 2 lakh crore, solidifying 2024 as the biggest year yet for the BSE and NSE.

Why Are IPOs So Popular This Year?

The reasons behind this surge in IPO interest are manifold. Here’s the gist:

- Economic Revival: As economies rebound post-pandemic, companies are capitalizing on improved investor sentiment.

- High Liquidity: Investors are flush with funds, seeking lucrative opportunities.

- Market Confidence: With the stock markets performing well, there’s renewed faith in IPOs as a reliable investment avenue.

What’s Next for IPO Enthusiasts?

If 2024 is any indication, the IPO market is poised for further growth. Investors are now keeping a close eye on upcoming listings, hoping for the next big opportunity on BSE or NSE. Who knows? The next IPO could be the one to redefine market trends yet again.

Lessons for Investors

While IPOs are exciting, they’re not without risks. Here are some takeaways for smart investing:

- Do Your Homework: Not all IPOs are created equal. Study the company’s financials and growth potential.

- Be Patient: Oversubscriptions can make it tricky to secure shares, but persistence pays off.

- Diversify: Never put all your eggs in one basket. Spread your investments across sectors.

Wrapping It Up

The success of Vishal Mega Mart, Sai Life Sciences, and One Mobikwik proves that the IPO market is thriving, offering tremendous opportunities for investors. The staggering Rs 2.2 lakh crore demand speaks volumes about the confidence in India’s growth story and the pivotal role of BSE and NSE in enabling it. Whether you’re a seasoned investor or a first-timer, the IPO market is a thrilling space to watch.

Read More: Vedanta Dividend News: A Record-Breaking Year for Shareholders

Conclusion

The numbers don’t lie. 2024 has been a blockbuster year for IPOs on BSE and NSE, and it’s only the beginning. With robust demand and record-breaking performances, these IPOs have set a benchmark for others to follow. If you’re keen to ride this wave, keep an eye on upcoming offers and prepare to seize the opportunity. After all, the best time to invest is when the market is buzzing with potential.