Introduction

Vodafone Idea Limited, the joint venture between Vodafone Plc and Aditya Birla Group, is facing significant financial hurdles as it strives to maintain its position in India’s highly competitive telecom market. Recently, the company proposed borrowing Rs 23,000 crore in term loans from banks, alongside requesting an additional Rs 10,000 crore in bank guarantees. This move, reported by The Economic Times, is part of Vodafone Idea’s broader strategy to raise the capital necessary to compete with larger rivals Reliance Jio and Bharti Airtel.

Efforts to Secure Funding

The proposal for the term loan was presented to a consortium of banks led by the State Bank of India (SBI). This step marks a critical phase in Vodafone Idea’s efforts to secure the funds required for expanding its 4G coverage and initiating greenfield 5G rollouts in strategic markets. The total capital expenditure plan amounts to Rs 55,000 crore, reflecting the company’s commitment to upgrading its mobile broadband network infrastructure in its 17 key areas.

To ensure that the loan request is thoroughly evaluated, the banks will seek a technoeconomic viability (TEV) report from a top consultancy firm. This report will assess Vodafone Idea’s creditworthiness and provide insights into the technological and economic risks associated with the company’s plans. A TEV analysis typically evaluates a company’s risks in terms of technology, markets, finances, and regulatory compliance, helping banks make informed decisions on sizable loans.

Addressing Lenders’ Concerns

Vodafone Idea has recently taken significant steps to satisfy lenders’ long-standing demands. Moreover The company secured nearly Rs 24,000 crore through various fundraising efforts, a crucial prerequisite for obtaining new loans. This included an almost Rs 18,000 crore follow-on public offering (FPO), which was subscribed 6.4 times, indicating strong investor interest despite the company’s ongoing financial struggles.

In addition to equity fundraising, Vodafone Idea has been negotiating with banks for debt and non-fund-based facilities amounting to Rs 25,000 crore and Rs 10,000 crore, respectively. Non-fund facilities typically involve bank guarantees, which provide assurance to lenders and stakeholders about the company’s financial commitments.

However, securing new loans is not straightforward. A senior official from a public sector bank emphasized the importance of ensuring that the telecom company can repay its debt, given its declining market share and substantial financial obligations.

Debt and Repayment Challenges

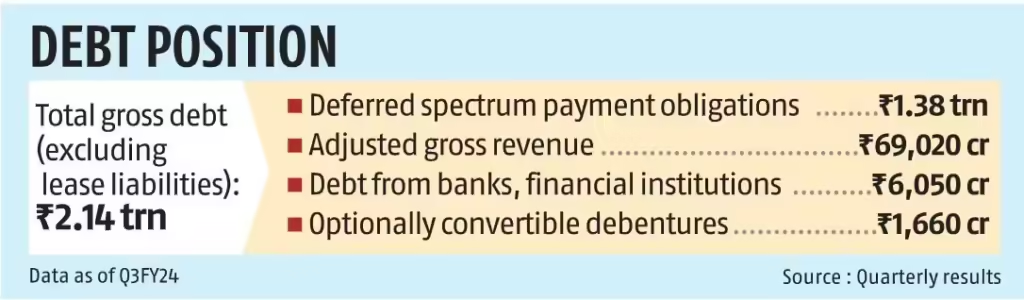

At the end of the third quarter of FY24. Vodafone Idea’s total gross debt, excluding lease liabilities, stood at a staggering Rs 2.14 trillion. Despite a reduction in debt from banks and financial institutions by Rs 7,140 crore to Rs 6,050 crore. The company still faces significant repayment challenges. In 2024 alone, Vodafone Idea is schedule to repay Rs 5,400 crore worth of debt.

Annual_Report_2022-23

Looking ahead, the company must pay Rs 12,000 crore to the government between October 2025 and March 2026, covering both principal and interest. This is followed by annual payments of Rs 43,000 crore from FY27 to FY31, reflecting the long-term financial strain on the company.

The government is Vodafone Idea’s largest creditor, holding a 33.4% equity stake after converting the company’s interest dues worth Rs 16,000 crore into equity. This conversion was related to deferred adjusted gross revenue (AGR) and spectrum installments, a critical issue in the Indian telecom sector.

Strategic Moves and Future Plans

Despite its financial challenges, Vodafone Idea is not deter. The company continues to engage with lenders for further debt fundraising and is exploring equity or equity-linked fundraising options. This effort is crucial for the company’s network expansion plans, including its anticipated 5G rollout. In March, Vodafone Idea executives met with institutional investors in Singapore and Mumbai to discuss these plans.

The Vodafone Idea Limited last raised significant funds in May 2019 through a rights issue amounting to Rs 25,000 crore ($3 billion), with the promoter group contributing Rs 17,920 crore ($2.2 billion). In 2022, the promoter group invested an additional Rs 4,900 crore ($600 million), demonstrating their ongoing commitment to the company.

Market Position and Competitiveness

Vodafone Idea Limited remains the third-largest telecom player in India, a market that has been increasingly dominate by Reliance Jio and Bharti Airtel. The telecom sector in India has been characterize by intense competition, price wars, and regulatory challenges, which have significantly impacted the financial health of companies like Vodafone Idea.

To remain competitive Moreover, Vodafone Idea must not only secure the necessary funding but also effectively implement its network expansion and technological upgrade plans. The successful rollout of 5G technology will be a critical factor in determining the company’s future market position. Additionally, improving customer service, expanding coverage, and introducing innovative services will be essential to retaining and growing its subscriber base.

Conclusion

Vodafone Idea Limited is at a pivotal juncture. Although The company’s efforts to raise capital and secure loans are crucial for its survival and growth in the fiercely competitive Indian telecom market. The outcome of the TEV report and the subsequent decisions by the banking consortium will significantly influence Vodafone Idea’s ability to execute its strategic plans.

Also Read: Vodafone Idea Limited Raises Rs 2,458 Crore for Expansion

Despite the challenges, the joint venture between Vodafone Plc and Aditya Birla Group is demonstrating resilience and a proactive approach to addressing its financial and operational issues. The coming months will be critical as Vodafone Idea navigates its path towards financial stability and market competitiveness. Aiming to reclaim its position as a leading player in the Indian telecom industry.